Nordic Investment Partners

Welcome to Nordic Investment Partners

About Nordic Investment Partners

Nordic Investment Partners was founded in 2017 by Ole Søeberg. Ole has a broad and long experience in global equity markets since early 1980's. He has been in investment banking, Investor Relations in large corporates and Asset Management and in various leadership roles.

Nordic Investment Partners functions as a family office. However, being a long term investor there's time for other activities such as;

Advisory, research and consultancy is provided within

Investment inspiration for investment funds and family offices. Focus on wealth preservation and growth using GARP and deep due diligence. External roadmaps are provided free on a quarterly basis. You may ask why to provide work that takes hours to make away for free. Well, they serve many purposes and over the years they have worked quite well and also stimulated my passion and curiousity around the investmentment world.

Ambassador and introducer for Brock Milton Capital Link

Global long only, concentrated portfolio of 30-35 companies. High quality champions' and a smaller section of 'special situations', growth without overpaying. Since inception in 2014 the fund has returned 15% per year (in SEK) and 3% better than MSCI World. The fund's founder Andreas Brock has made this book for better insight in the investment thinking

Nordic Value investment learning and inspiration 'not-for-profit' conference

Contributor and/or speaker at Børsen All-Star team, Cyprus Value, ValuEspana, ValuX, Miilionærklubben, MOI Global and SumZero and other. Investor idea sharing and always good education and inspiration

Reach out if you're interested knowing more.

You can reach me on ole.soeberg@nordic-investment-partners.com or via the contact box

On this website you find

Investment roadmaps and quarterly updates for inspiration and education only

Nordic Value Conference - a conference for investment entusiast sharing investment ideas. More on Nordic Value section on this site

Pitches and illustration for investment proces for a single company

Monthly observation

Expected returns and who sets the price for an asset

31 March 2024

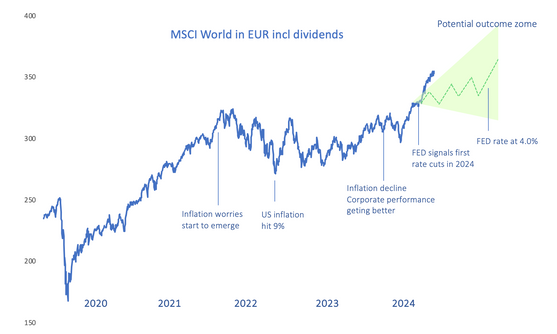

The global stock markets have started 2024 on a strong note. In USD markets are up 8%, equal to more than 8.000 billion USD of paper wealth. This creates a comfort for the millions of savers holding stocks either directly, via funds or in their pension scheme.

In the Monthly comment from early 2024 I emphasised stock markets started 2024 at 15x fwd P/E and saying it's not demanding and as interest rates likely decline in line with lower inflation during 2024, then there's room for a valuation expansion. 2024 therefore looks like a 10-20% return year.

That's more than the 'normal' 6-7% return per year forecasted by academia, large funds and market commentators. So who is setting prices higher in 2024 (and who did it in 2023 for that matter) ?

Check the 1Q 2024 Roadmap update for inspiration on this.

Contact

Nordic Investment Partners is owned by Ole Søeberg. More on LinkedIn

info@nordic-investment-partners.com

Fell free to reach out via the boxes below: