Nordic Investment Partners

Investment focus

INVESTMENT EXPERIENCE AND FOCUS

Four decades of investment experience learns you a lot. Some investors like Warren Buffet has even seven decades of investment experience. Over my four decades I've learned it's a good idea to listen to experienced investors and their learnings. All investors have periods for superior or sub-par performance, but over time you learn how to weed out the businsses, trends and themes that do not perform well in the long run.

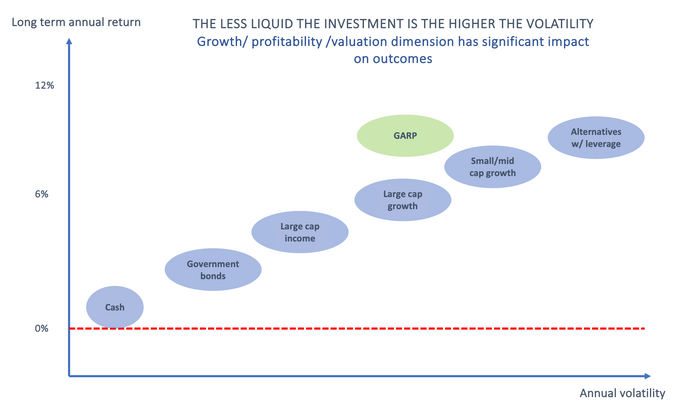

EXPECTED INVESTMENT RETURNS IN THE LONGER RUN

Based on historical performance over many decades and decomposing those returns one can get a rough estimate for expected future returns. The below illustration is simply to show that if you want higher returns you need to take on more 'risk' i.e. volatility. For bonds and equity investors the real risk is bankruptcy - a position from where it's very difficult to recover your capital

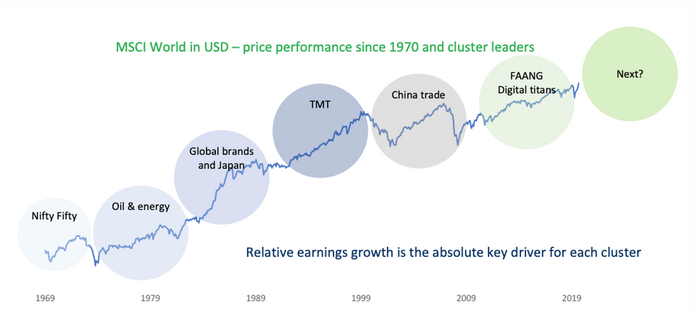

WHERE TO FIND GOOD LONG TERM EQUITY INVESTMENTS

My curiousity centers around how to find a evergreen company i.e a company that outgrows others in a profitable way (high ROCE) and to the benefit of customers, shareholders, employees and surrounding society?

It's less complicated than you think, but it takes a lot of time and you have to turn many stones to find the good ones. Focus on what makes the business unique, how can it grow in a profitable way, how are the people that run's the business, how is the profile of cash flow growth and return on invested capital. And importantly - do not overpay for even what seems the best company in the world

Having structural tailwind makes the investment return easier and oddly enough each of the past six decades have their unique major tailwind. The 1970ies saw oil&gas companies outperform significantly as their cash flows followed higher energy prices. In the 1980ies deregulation of trade and financial markets made companies benefitting from those factors outperform via cash flow growth. In 2010ies the large US based tech companies dominated the digitalization of social interaction and wider use of data and the FAANG theme replaced the BRICs as leaders.

Future growth clusters are found inside the Roadmaps on this web-site. For a quick overview here's a few samples:

THE KEY INVESTMENT VIEW FOR 2020s

The 2020s decade will likely be characterized by modest economic growth due to low population growth and 1-2% productivity growth. Inflation will probably be 2-3% despite being very volatile in the first couple of years in the 2020's.

The most likely structural growth drivers for the next 10-15 years are;

Deep digitalization of almost anything. Exponential growth in data and how its collected, sorted, analysed and processed into decision making. Either by human or machine. 20% of global stock markets are assigned as 'tech in 2020'. By 2030 'digital enablers' will likely constitute more than 50% of global market cap as data/knowledge gets embedded into business daily operations. Semiconductors, software and completely new ways of doing things promise a very interesting future

Low carbon world is essential if Earth is to be inhabitable in year 2300. Humankind stand in front of the biggest investment ever made as we move energy sourcing from fossil fuels towards renewable. Electrification will power much more in the future and where electricity is not possible it will be hydrogen and ammonia. Low carbon world also include a move away from traditional foods into plantbased food ingredients.

Healthcare efficiency and disease prevention with monitoring current health and genetic health issues. Many more diseases will be curable and preventable. Diabetes, cancer, cardiovascular, Alzheimer and other large disease areas will see new prevention and better treatments in 2030. Early detection genomics and advanced individualized treatments will be more common. Good lifes will also mean longer lives and the number of inviduals over 100 years old and still being fresh in body and mind it going to surprise on the upside. That's why you need a good investment manager so your savings last

Global affluence with 150-200 million individuals joining the global middle class on an annual basis (that's more than 400.000 individuals every day). That creates multi-year increased demand for better food, water, electricity, transportation, communication, energy, education and health

The traditional business and inventory cycle still applies, so from period to period growth and inflation will change. However, in a world with evermore data and analytics the efficiency of eco systems will likely reduce the magnitude of economic swings as end-to-end value chains reduce slack and inefficiency. The early 2020's have learnt us a lesson about fragile supply chains and that mistake will not be repeated, so expect much more local/regional production and less sourcing from the other side of Earth.

Risks of financial mis-allocation of capital is the same as past decades. Since 2008 crisis the biggest lenders have been governments but that cannot continue forever. And the solution for debtors is inflation, so moderate inflation is of interest of politicians.

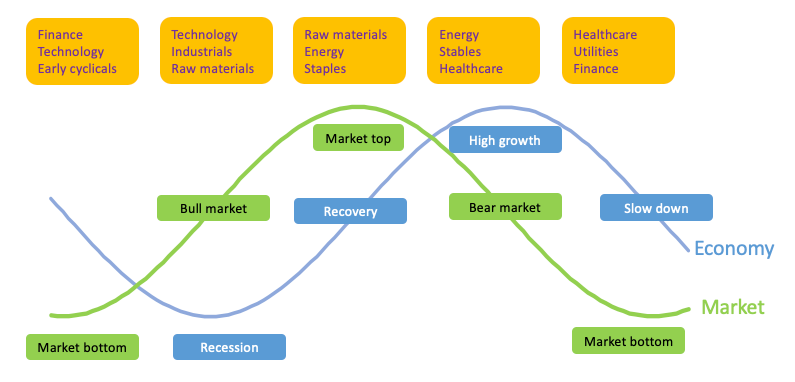

I did the first drafts of a stock market cycle vs economic cycle many years ago and have refined the method so the current illustration is like this: